The Power of Compound Interest

At Empower Invest USA, we believe that understanding compound interest is crucial to your financial success. This powerful concept can significantly accelerate your wealth growth over time, especially when you start early.

What is Compound Interest?

Compound interest is the interest you earn on both your original investment and the interest it has already accrued. It's like a snowball effect for your money – the longer it rolls, the bigger it gets.

The Magic of Starting Early

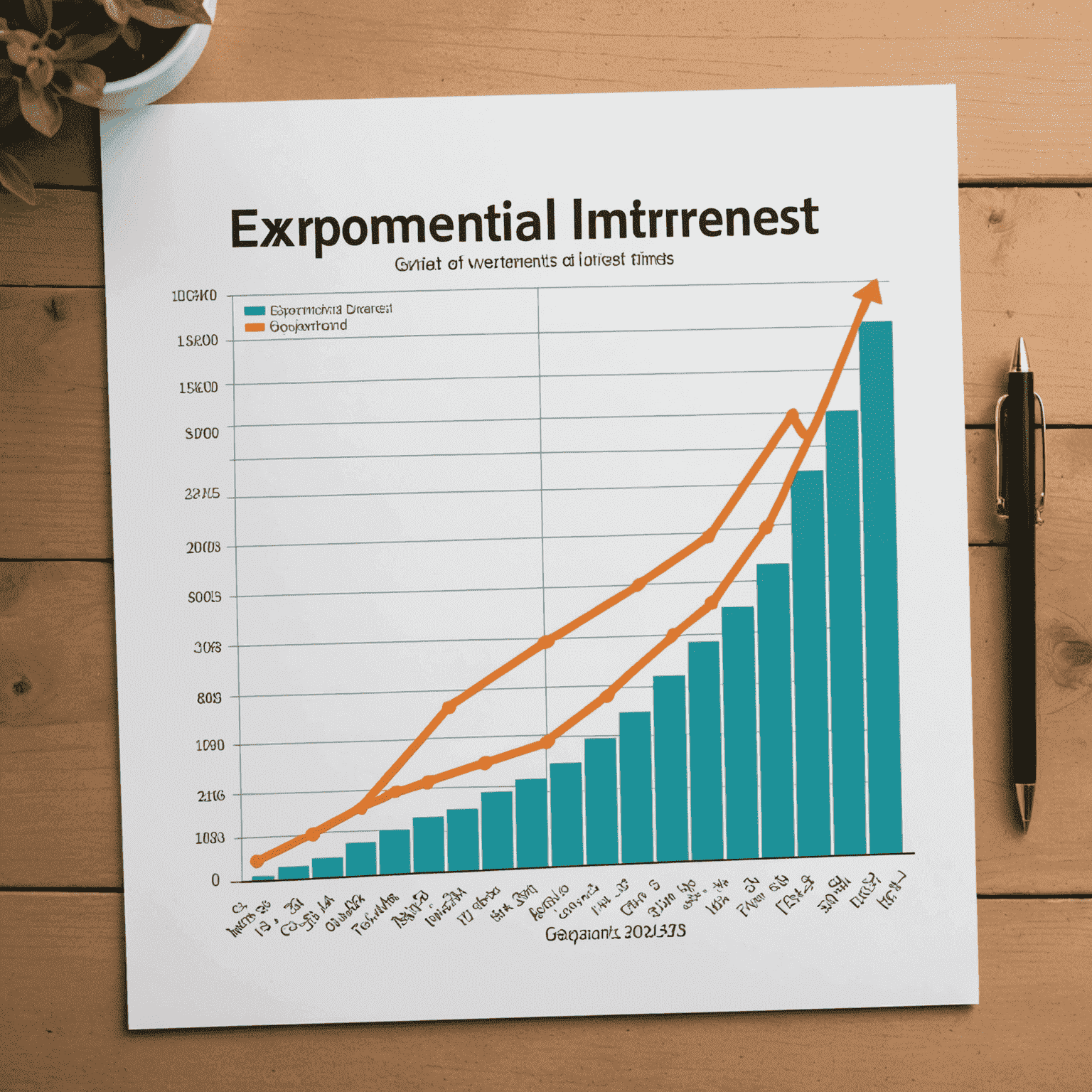

Time is the secret ingredient that makes compound interest truly powerful. The earlier you start investing, the more time your money has to grow exponentially. Let's look at an example:

Imagine two investors, Alex and Sam:

- Alex starts investing $5,000 annually at age 25

- Sam starts investing $5,000 annually at age 35

- Both invest until age 65 with an average annual return of 7%

By age 65:

- Alex's investment grows to approximately $1,068,048

- Sam's investment reaches about $505,365

Alex's 10-year head start results in over $562,000 more in savings!

Harnessing Compound Interest with Empower Invest USA

At Empower Invest USA, we're committed to helping you leverage the power of compound interest. Our expert advisors can guide you in creating an investment strategy that maximizes your long-term growth potential.

Key Takeaways

- Compound interest accelerates wealth growth over time

- Starting early dramatically increases your potential returns

- Consistent investments, even small ones, can lead to significant wealth accumulation

- Empower Invest USA can help you create a strategy to maximize compound interest benefits

Remember, the best time to start investing was yesterday. The second best time is now. Let Empower Invest USA help you begin your journey to financial success today.